Optimal Timing for Home Purchases and Sales in the U.S.: Market Trends and Seasonal Patterns

December 16, 2024

Joel Efosa

Joel efosa is an experienced NATIONWIDE fire damage real estate investor. As owner of fire cash buyer, my goal is to provide fire victims with more options wether its rehab, sell or financial help.

He’s been featured on multiple publications including

Realtor, Yahoo Finance, Business Insider, Nasdaq, MSN, Fox, Go Banking Rates, Homelight

At Fire Cash Buyer, we promote strict editorial integrity in each of our posts.

Table of Contents

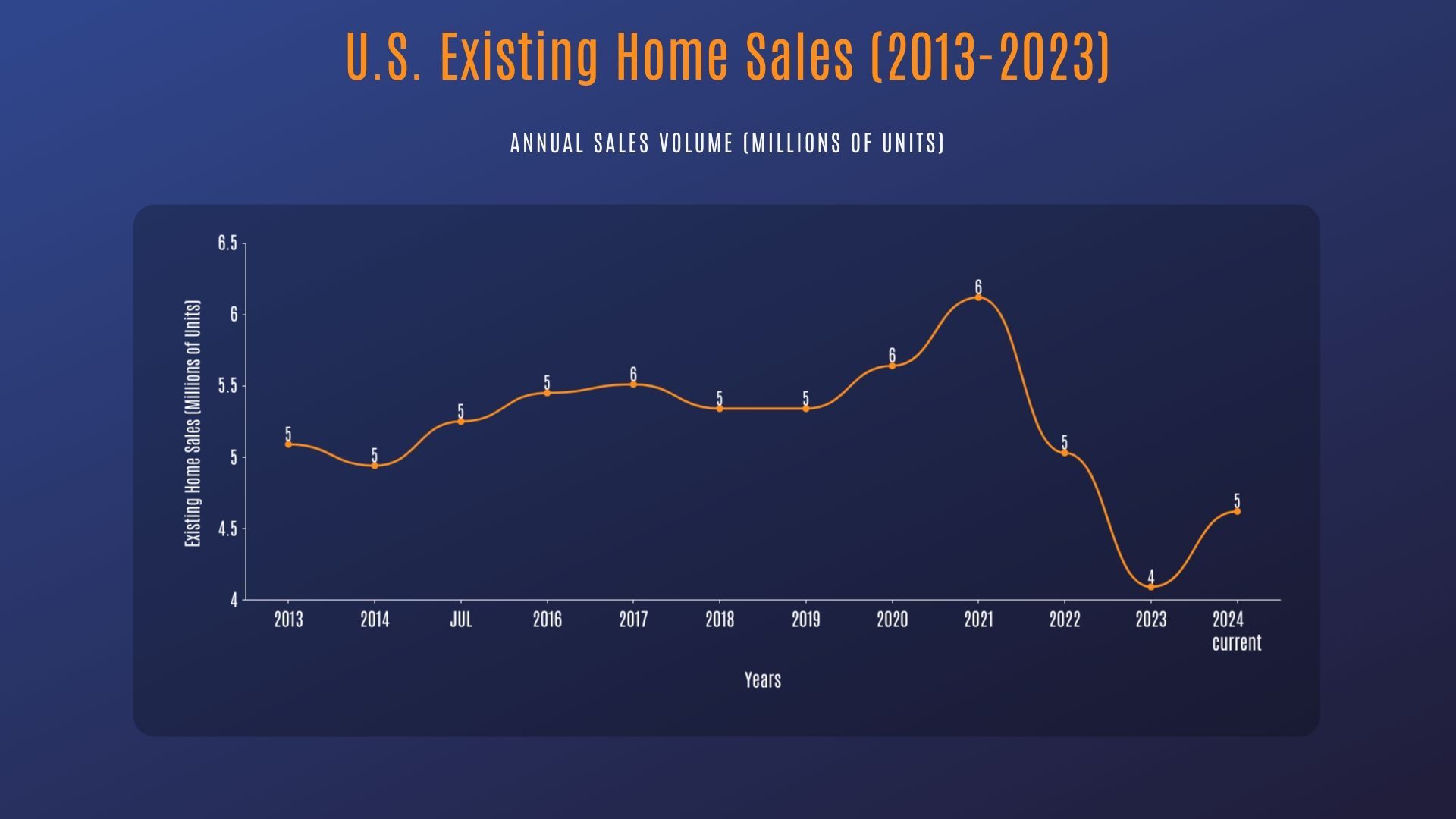

Overview of the U.S. Housing Market

Seasonal Trends in Home Purchases and Sales

- Understanding Seasonality in the Housing Market

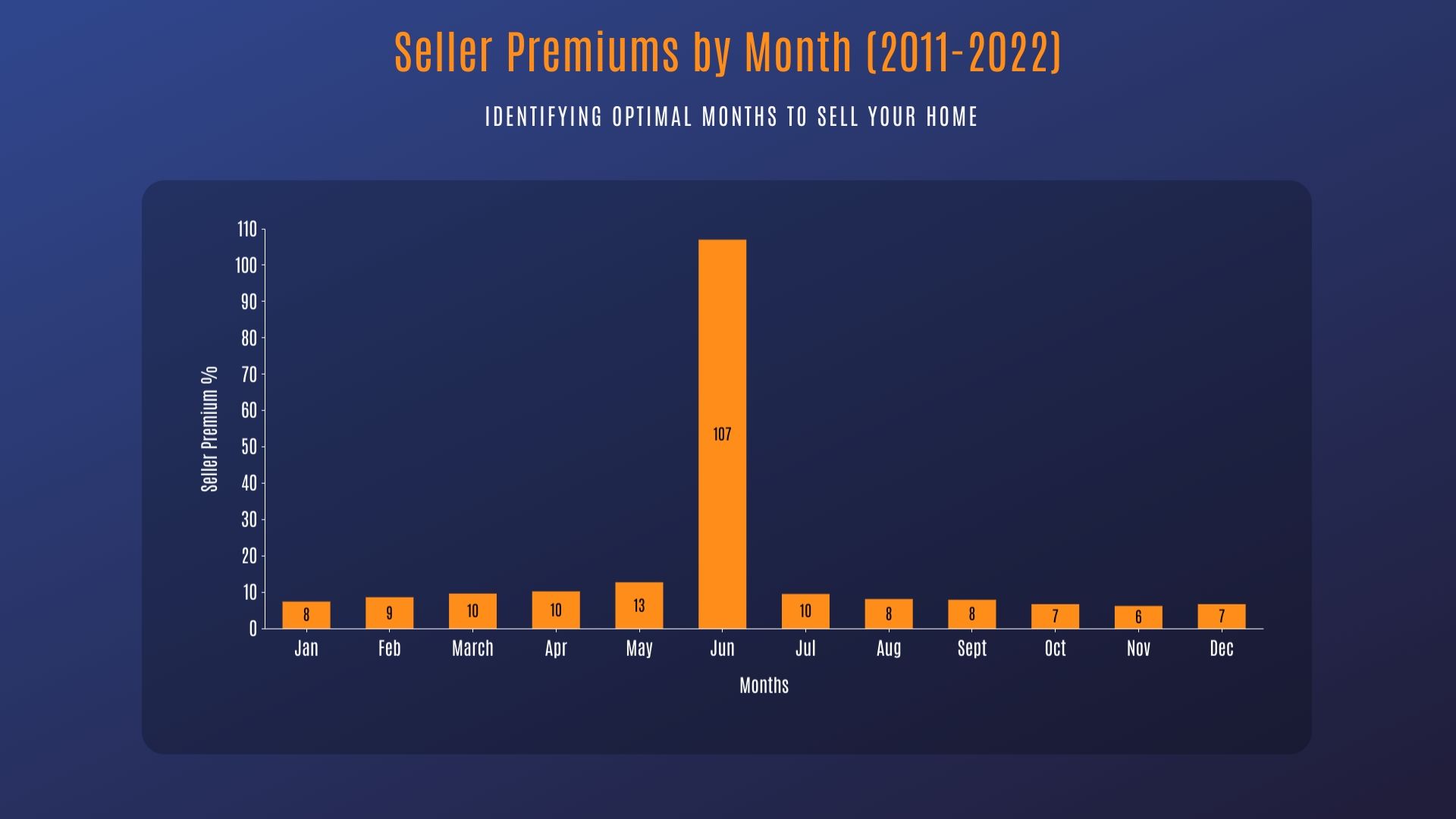

- Optimal Time to Sell Homes

- Optimal Time to Buy Homes

- Impact of Seasonal Trends on Market Dynamics

Factors Influencing Optimal Timing for Buying and Selling

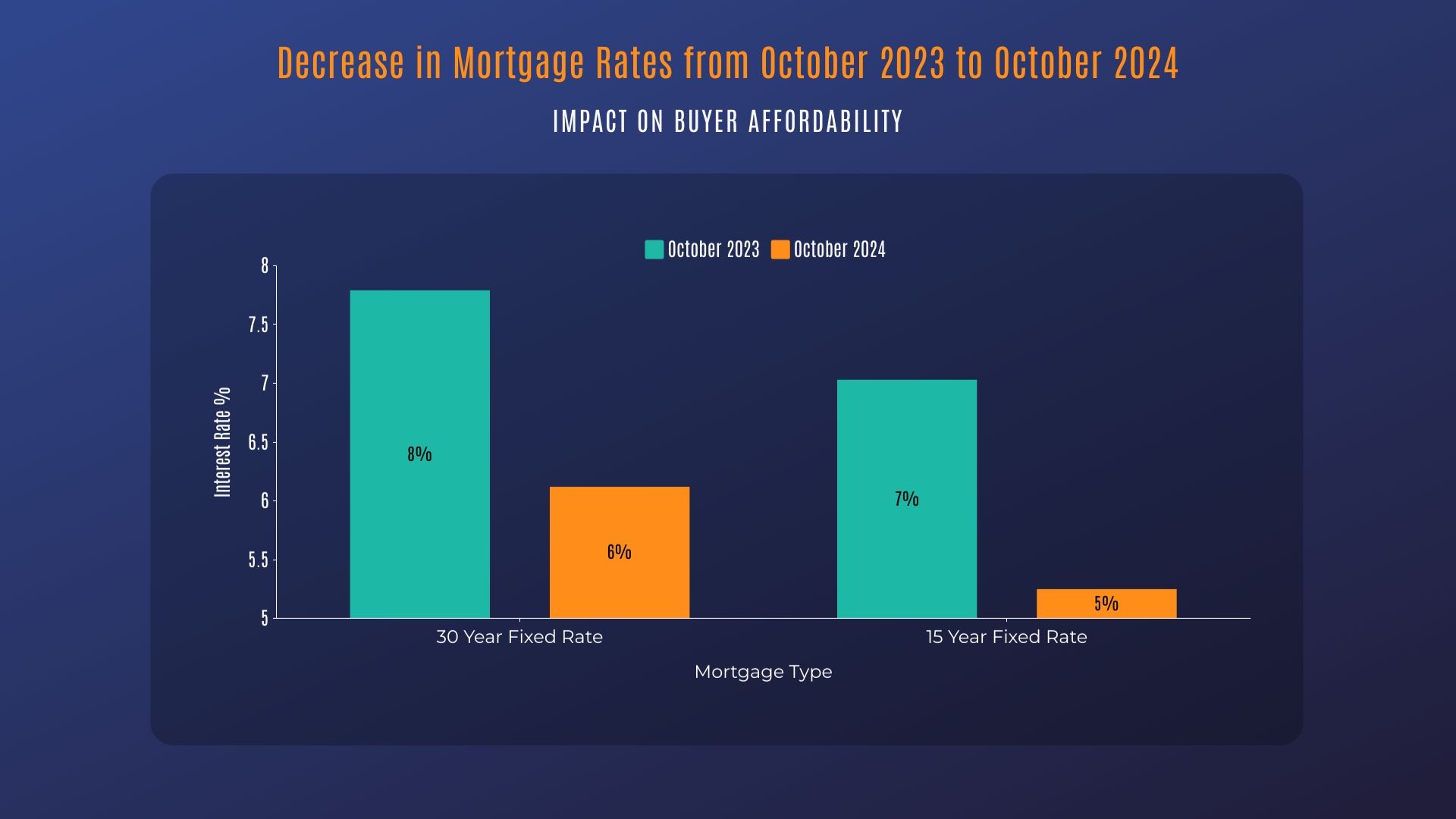

- Mortgage Rate Trends

- Housing Inventory Levels

- Buyer Demand and Competition

- Regional Variations and Migration Patterns

Regional Analysis of Optimal Timing

Insurance Market Withdrawal and Challenges

Understanding the optimal timing for buying or selling a home can significantly impact financial outcomes in the U.S. housing market. This report provides a comprehensive analysis of market trends, seasonal patterns, and future predictions to identify the best times for real estate transactions.

Insurers are increasingly reluctant to offer coverage in high-risk regions. According to recent studies, states like Florida and California are experiencing significant insurance market disruptions. In Florida, over 15 insurance companies have ceased operations or stopped writing new policies, creating a severe insurance availability crisis. California has seen major insurers like State Farm and Allstate dramatically reduce or halt new homeowner insurance applications due to escalating wildfire risks.

The mortgage lending ecosystem is directly impacted, as most mortgage lenders require comprehensive property insurance. This creates a challenging scenario where homeowners in high-risk areas struggle to maintain mortgage compliance due to insurance unavailability.

Emerging Insurance Market Adaptation Strategies

The increasing frequency of climate-related disasters is forcing significant transformations in the home insurance landscape. Key adaptation strategies include:

Risk-Based Pricing Models

Insurers are developing more sophisticated, data-driven pricing models that more accurately reflect localized climate risks. These models leverage advanced geospatial analytics, historical climate data, and predictive modeling to determine precise risk assessments.

Alternative Risk Transfer Mechanisms

1. Parametric Insurance: Policies that provide predetermined payouts based on specific triggering events like wildfire intensity or acres burned.

2. Catastrophe Bonds: Financial instruments that transfer specific climate-related risks to capital markets.

3. Public-Private Risk Sharing: Collaborative frameworks where government and private insurers share potential losses.

Resilience-Focused Insurance Products

Innovative insurance products now offer:

- Discounts for property mitigation investments

- Comprehensive wildfire prevention support

- Rapid recovery and rebuilding assistance

- Enhanced risk management consultations

Technology-Driven Risk Mitigation

Insurance companies are investing in:

- Satellite and drone monitoring of wildfire-prone regions

- Advanced early warning systems

- Real-time risk assessment technologies

- Predictive maintenance recommendations for homeowners

Economic Burden on Homeowners

Beyond direct disaster costs, homeowners face escalating financial challenges:

- Average home insurance premiums in high-risk wildfire zones have increased by 300% in the last decade

- Some states like California and Florida see annual insurance costs exceeding $6,000

- Approximately 15% of homeowners in high-risk areas struggle to obtain any insurance coverage

Conclusion

Key Takeaways:

- Timing is Crucial: Understanding seasonal trends can significantly impact financial outcomes.

- Sellers: Listing in May may yield premiums up to 12.8% [1].

- Buyers: Purchasing during late September to early October can result in savings up to $14,000 [2].

- Market Dynamics: Factors like mortgage rates, inventory levels, and buyer demand influence optimal timing.

- Regional Variations: Local market conditions and migration patterns affect timing strategies.

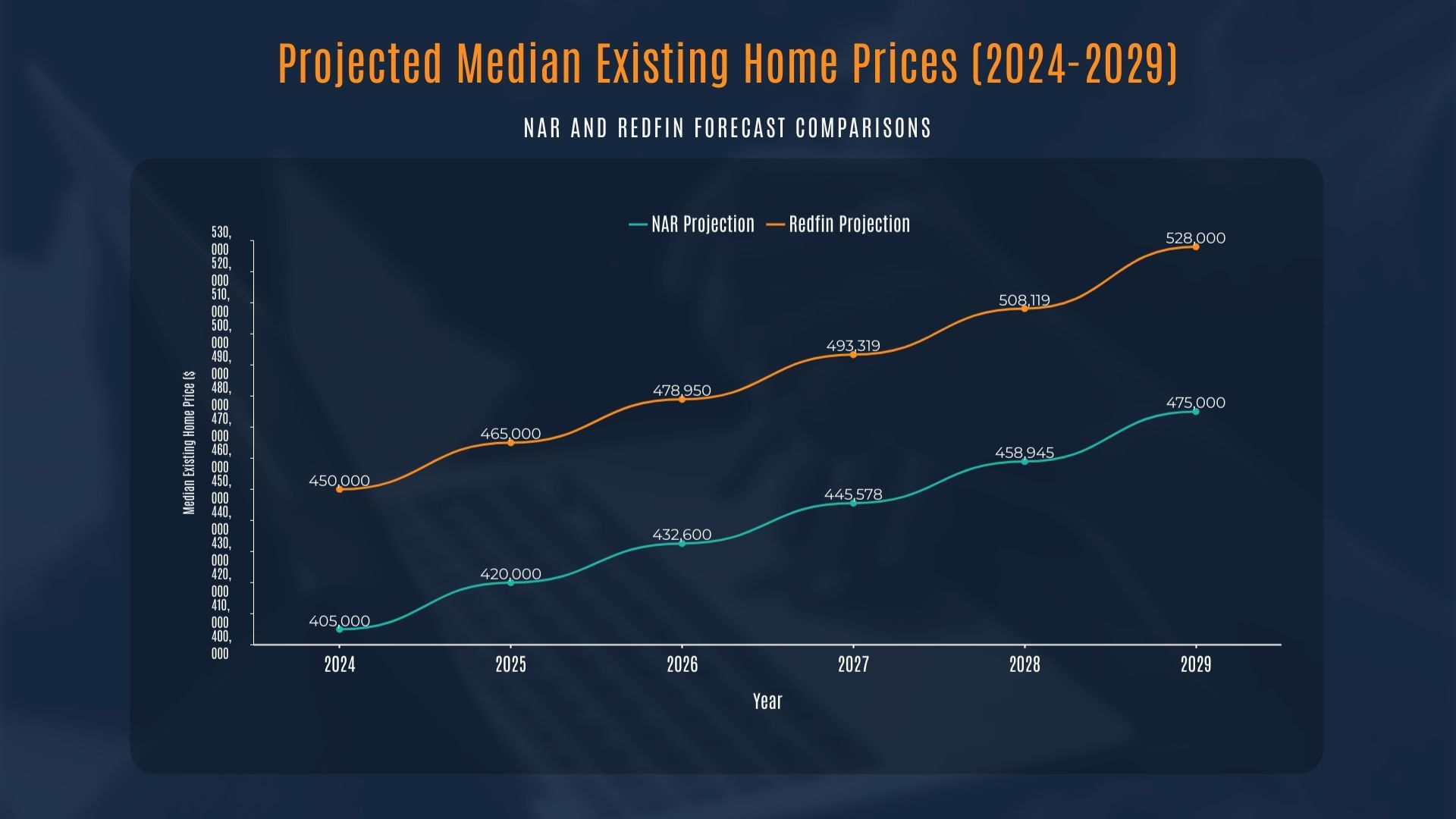

- Future Outlook: Gradual home price appreciation and stabilizing mortgage rates are expected, but ongoing monitoring is essential.

Final Thoughts:

By leveraging data-driven insights and staying informed about market trends, buyers and sellers can make strategic decisions to optimize their real estate transactions.

Insurance Market Reform

Develop standardized climate risk disclosure requirements

- Create state-level insurance risk pools

- Establish clear guidelines for fair insurance pricing

- Support development of alternative insurance mechanisms